请 更新浏览器.

发现

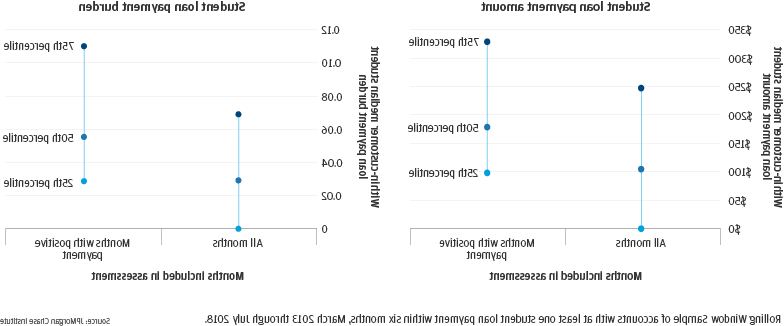

- 去找1典型家庭的学生贷款中位数为每月179美元或5美元.每月的实得收入的5%. 四分之一的家庭将超过11%的实得收入用于助学贷款.

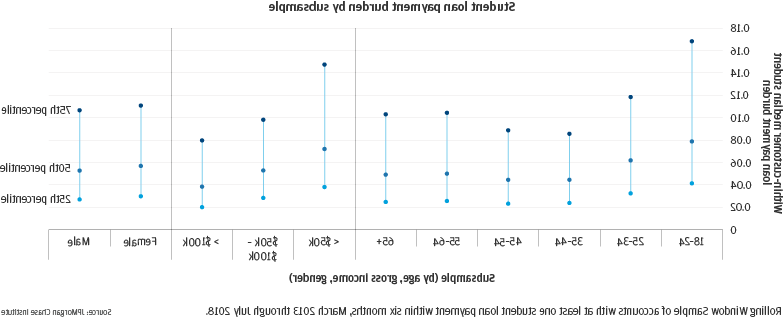

- 去找2年轻家庭和低收入家庭的学生贷款负担最重, 但男性和女性账户持有人的负担没有实质性差异.

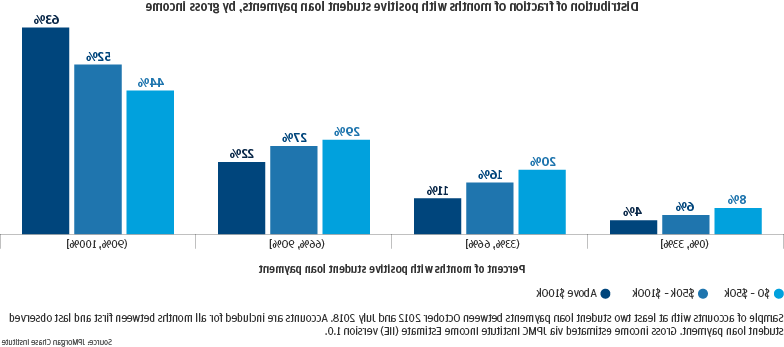

- 去找3总的来说,54%的家庭持续支付学生贷款, low-income families are less likely to make consistent loan payments (44 percent) compared to high-income families (63 percent).

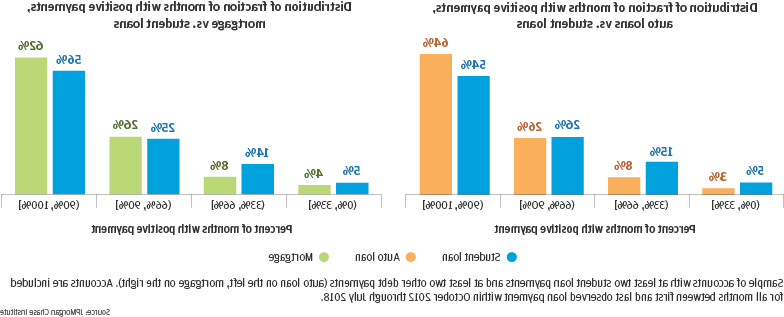

- 去找4在积极偿还多重贷款的家庭中, the proportion making consistent payments is lower for student loans than auto loans (10 percentage point difference) and mortgages (6 percentage point difference).

- 去找5收入, 流动资产, 和支出 increase sharply prior to starting student loan payments and decrease after stopping student loan payments.

下载

学生贷款债务是增长最快的家庭债务类别, 在过去的十年里翻了一倍多,达到了1美元.2018年将达到5万亿美元,仅次于抵押贷款债务,影响4500万借款人. Although the financial returns from a higher education degree over a lifetime typically exceed the costs, 大约22%的学生贷款借款人违约. 结果是, some have framed the “student loan crisis” as a crisis of student loan repayment rather than student loan debt. Since 2009 a range of income-driven repayment options has emerged to mitigate the financial burden for families by better aligning repayment obligations with their ability to pay.

A major complication in policymakers’ ability to propose promising solutions is the lack of data on how families—not just individual borrowers—are shouldering the burden of student loan repayment and the impact of student loan debt on other financial outcomes. The central challenge is that student loan payments and debt information are difficult to observe in conjunction with other financial outcomes, 比如收入, 支出, 以及其他债务支付, 当然不是在大样本的高频基础上.

有了这份报告, the 12bet官方 研究所 aims to describe how student loan payments fit into the context of families’ larger financial lives. 我们为辩论提供了新的见解, 从学生贷款支付的高频现金流角度以及它们与家庭收入的关系, 流动资产, 支出, 以及其他债务支付. 这个角度来看, based on student loan payment transactions observed out of a universe of 39 million 追逐 checking accounts between October 2012 and July 2018, 新颖不只是因为样本量大吗, 而且,它还可以看到私人和联邦学生贷款的支付情况(包括任何费用和罚款)。, 与收入, 支出, 流动资产, 以及其他债务支付. 除了, 这个数据资产在其家族视图方面是不同的, which allows us to take into consideration the potential for a family to be making payments on multiple student loans and on behalf of other borrowers. 这是很重要的, 但往往被忽视或隐藏的一块学生贷款偿还的画面, given that roughly 19 percent of individuals report receiving help from others to pay off their student loans.

有了这个新的数据资产,我们的目标是回答五个关键问题:

- 学生贷款在家庭收入中所占的比例是多少?

- 学生贷款支付的经济负担在不同的人口群体中有何不同?

- 家庭偿还学生贷款的一致性如何,偿还金额的波动性有多大?

- 学生贷款支付与其他类型的贷款支付有什么不同, 尤其是汽车贷款和抵押贷款?

- 学生贷款是如何随着收入、流动资产和支出而波动的?

找到一个: 典型家庭的学生贷款中位数为每月179美元或5美元.每月的实得收入的5%. 四分之一的家庭将超过11%的实得收入用于助学贷款.

发现三: 总的来说,54%的家庭持续支付学生贷款, low-income families are less likely to make consistent loan payments (44 percent) compared to high-income families (63 percent).

发现四: 在积极偿还多重贷款的家庭中, the proportion making consistent payments is lower for student loans than auto loans (10 percentage point difference) and mortgages (6 percentage point difference).

Data

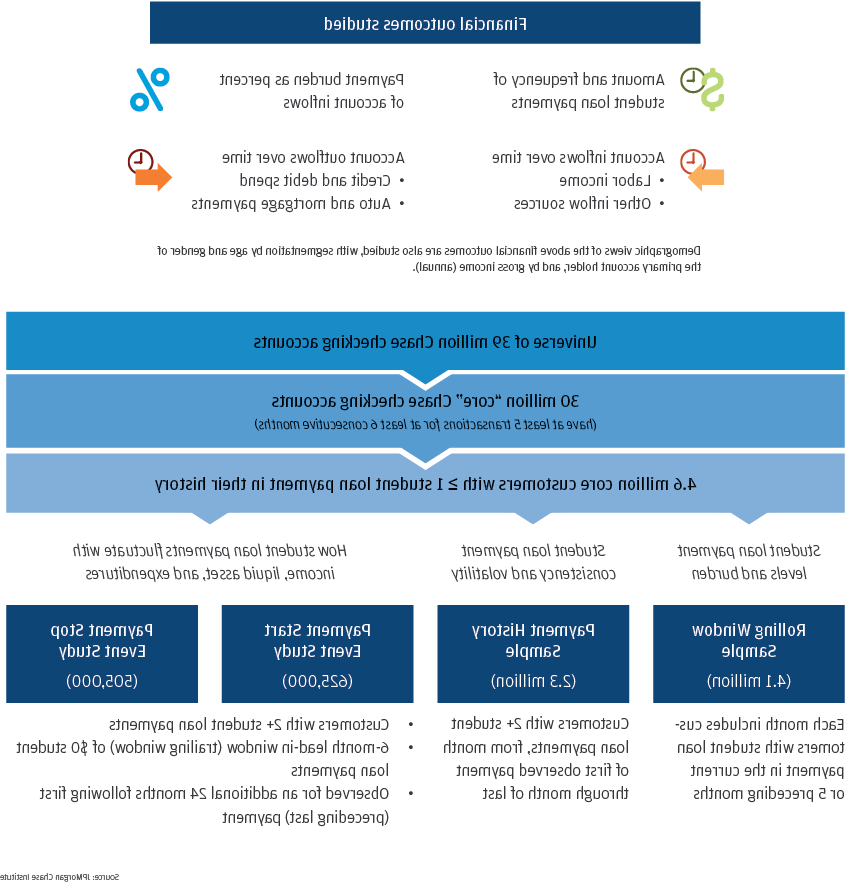

对于这项研究, we assembled several distinct data assets from an overall sample of 12bet官方 families that made student loan payments from their 追逐 checking accounts.

We began with a universe of 39 million families with 追逐 checking accounts between October 2012 and July 2018. 从这个宇宙, we constructed a subset of 30 million “core” accounts for which we observe sufficient activity to consider the account a primary financial vehicle for the family. 从这些核心账户中,我们确定了4个.600万个家庭用他们的大通银行支票账户支付了至少一笔学生贷款.

用于分析的数据资产是从这个基数4创建的.600万个家庭. 每个样品使用不同的纳入标准,用于不同的分析目的, 如下图所示. 有关其他详细信息,请参阅数据资产和方法部分.

结论

综上所述, 我们的见解从这个新的, 高频镜头切入学生贷款还款行为对政策制定者具有重要意义, 金融机构, 高等教育机构, 和雇主. There are important segments of the population who are still significantly burdened by student loan payments, 尤其是年轻和低收入的账户持有人, 尽管有收入驱动的还款计划. 特别是, 学生贷款的支付对收入的大幅变化很敏感, 并且可能缺乏足够的机制来调整支付以适应收入波动. Insofar as student loan payments are less consistent and more volatile than auto loan and mortgage payments, families may be benefiting from the greater leniency that exists with student loan repayment compared to other loan types. 仍然, it remains to be seen whether the negative consequences of this lower consistency will outweigh the benefits of greater leniency. 整体, there may be better ways to structure or implement student loan repayment plans that would ensure that families are not over-burdened and are able to make consistent payments. Revisiting underwriting and federal student aid criteria and considerations might help address the root of the student loan repayment problem. 更广泛地说, 大专院校, 雇主, 金融机构在帮助借款人管理学生贷款债务方面发挥着作用.